HR1 2025

Vote

One Big Beautiful Bill Act

Date of Vote: July 1, 2025

Chamber of Origin: SenateThis bill is a comprehensive legislative package covering multiple areas of federal policy, with significant changes to tax, energy, agriculture, defense, and other sectors. The bill aims to modify and in some cases terminate various tax credits, energy programs, and government spending initiatives. Key provisions include: Tax Reforms: The bill extends and modifies several individual and business tax provisions, including reducing tax credits for clean energy technologies, extending reduced tax rates for middle-class families, and creating new tax benefits like the "Trump Accounts" for children. It also introduces new restrictions on tax credits for foreign entities and modifies rules for international business taxation. Energy Policy: The bill significantly reduces support for green energy initiatives, terminating or restricting credits for clean vehicles, renewable energy, and various green technology programs. It simultaneously promotes traditional energy sectors like oil, gas, and nuclear energy by providing supportive tax and regulatory provisions. Agricultural Provisions: The bill includes modifications to agricultural support programs, including changes to crop insurance, disaster assistance, and commodity support mechanisms. It also adjusts rules for agricultural land sales and farmer tax benefits. Defense and Military Spending: The bill provides substantial funding for defense resources, including investments in shipbuilding, missile defense, military infrastructure, and technology development. Healthcare and Social Programs: The bill makes changes to Medicare, Medicaid, and health insurance programs, including modifications to eligibility requirements and funding mechanisms. Immigration and Border Security: The bill includes provisions for border infrastructure, immigration fees, and related enforcement activities. The overall approach reflects a shift towards more traditional energy and economic policies, with a focus on domestic production, reduced green energy subsidies, and modified tax structures.1

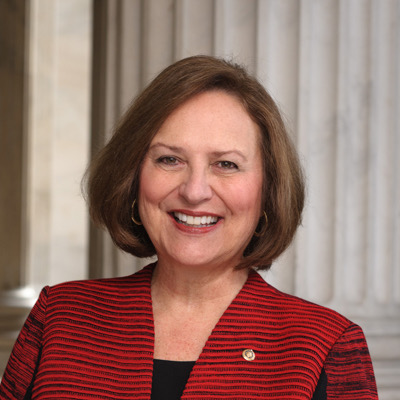

Turning Point Action’s Position

Voted YEA

50VOTED NAY

50Voted yea

Voted nay

Not voting

Present

Abstaining

DONATE

Our mission is unachievable without your help. We accept a wide range of donation options to ensure the preservation of this great country!